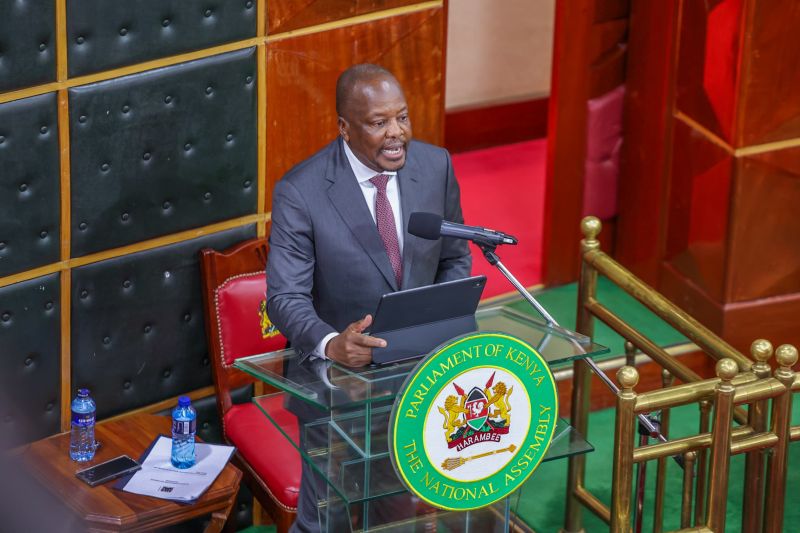

CS Kagwe announces policy overhaul for sugar, tea and miraa to protect farmers’ earnings

Agriculture CS Mutahi Kagwe detailed 30-year leases for four state sugar mills and wide-ranging tea reforms targeting Sh100 per kilo by 2027, aiming to protect farmers and restore sector profitability.

State-owned sugar factories leased out to four private companies will operate under strict regulatory oversight, with all private investments returning to government ownership after 30 years.

Agriculture Cabinet Secretary Mutahi Kagwe said the policy shift aims to restore profitability while protecting farmers and encouraging private capital in the sector.

More To Read

- Kenya exports up to 17 tonnes of miraa daily to Somalia, government confirms

- Factory farming in Africa: Development banks see it as a good idea, but it’s bad for the climate

- AU calls for rapid tech adoption in farming to shield continent from food crises

- Rift Valley tea producers clash over pricing and representation

- CS Kagwe urges bold reforms in agriculture sector as Intergovernmental Agriculture Forum opens in Naivasha

- Kenya wants China to remove tariffs on coffee, tea, avocados as trade imbalance persists

Kagwe explained that the leased factories are regulated under the Sugar Act, 2024, which established the Kenya Sugar Board (KSB) with broad powers to oversee cane development, harvesting, milling operations and farmer protection.

“Following the leasing of the four state-owned sugar mills, none of the sugar companies controls more than 50 per cent of the market,” he said, noting that both KSB and the Competition Authority will retain strict oversight.

He further clarified that lease proceeds will directly benefit local farming communities through payment of farmers’ bonuses and investment in cane development, as the government shifts away from direct mill management to a regulator and enabler role.

The four mills, Nzoia, Chemelil, Sony and Muhoroni, will be leased for 30 years to West Kenya Sugar Company, Kibos Sugar & Allied Industries, Busia Sugar Industry, and West Valley Sugar Company, respectively. The lessees are required to invest in massive cane development programmes, rehabilitate and modernise factory equipment and adopt new technologies to improve milling efficiency and recovery rates.

They must also diversify into cogeneration of power, production of bioethanol and allied products, while ensuring the management and maintenance of nucleus estates and out-grower systems to secure a sustainable cane supply for the factories.

Kagwe reaffirmed that the leasing of the four mills marks a policy shift in the management of public sugar assets, aimed at attracting private capital, restoring production, cutting losses, protecting farmers, creating jobs and returning the industry to profitability.

Tea sector

In the tea sector, Kagwe unveiled a reform programme aimed at stabilising prices, improving quality and increasing farmers’ earnings to Sh100 per kilogramme of green leaf by 2027.

Measures include stricter enforcement of greenleaf quality standards, establishment of a Tea Quality Laboratory in Mombasa and implementation of a Strategic Tea Quality Improvement Programme.

The government is also supporting factory modernisation through a Sh3.7 billion concessional loan facility, abolishing the reserve price to stimulate market demand and intensifying efforts to curb greenleaf hawking and theft.

Additional measures include governance and financial audits for underperforming factories, expansion into digital tea-marketing platforms, strengthened international market engagement under the AfCFTA framework and the introduction of the Tea Levy Regulations, 2024, to support sustainable sector financing.

Kagwe said the ministry is also reviewing the bonus payment model to allow farmers to receive bonuses quarterly instead of annually, easing liquidity pressures at the household level.

“These reforms are meant to ensure fair, transparent and uniform earnings for all tea farmers across the country, regardless of region,” he said.

Other Topics To Read

- Headlines

- National

- miraa

- Agriculture

- cane farmers kenya

- sugar industry

- tea farmers

- Kenya Sugar Board

- Mutahi Kagwe

- Bottom-Up Economic Transformation

- sugar mill leasing

- tea sector reforms

- tea bonus payments

- Tea Levy Regulations 2024

- miraa exports

- Kenya agriculture policy

- CS Kagwe announces policy overhaul for sugar

- tea and miraa to protect farmers’ earnings

He said farmers are currently paid through a two-tier model comprising a monthly initial payment and an annual second payment.

“Our goal is to ensure every tea farmer earns a dignified, predictable income. These reforms are not cosmetic; they are structural,” he told MPs.

Farmers currently receive between Sh23 and Sh25 per kilogramme as the initial payment, while the annual bonus varies depending on auction prices, exchange rates, and production costs.

In the 2024/25 financial year, average auction prices declined to $2.41 per kilogramme of made tea from $2.54, a drop attributed to forex shortages in Pakistan and Egypt, instability in Sudan and trade-access challenges in Iran—markets that collectively absorb about 70 per cent of Kenya’s tea exports.

Regional disparities in earnings persist, with factories east of the Rift Valley averaging $2.95 per kilogramme, compared to $1.78 in the west. Farmers in the East earned an average of Sh69 per kilogramme of green leaf, compared to Sh38 in the West, against a national average of Sh56.

Rising production costs have also added pressure. The average cost of producing a kilogramme of made tea rose to Sh112.96, with West of Rift factories facing higher costs of Sh134.34. The ministry linked these costs to staffing levels and operational inefficiencies.

“Some factories are not operating optimally, and this affects farmers’ returns,” Kagwe said.

Tea bonus

Kagwe appeared before the National Assembly on December 3, 2025, responding to a query by Nominated MP Dorothy Ikiara regarding criteria for determining tea bonuses and measures to ensure fair and uniform payments.

He explained that the final tea bonus, or “second payment,” is calculated as the balance of total sales minus production costs, influenced by auction price, exchange rates and production costs. He disclosed that in 2024/25, average payments to farmers dropped to Sh56 per kilogramme of green leaf, a 12.5 per cent decline from the previous year, with West of Rift farmers receiving the lowest payouts at Sh38.

To address the disparities, Kagwe unveiled reforms under the Bottom-Up Economic Transformation initiative, including raising average payments to Sh100 per kilogramme by 2027, finalising national green leaf quality guidelines, establishing a quality analysis and tea tasting laboratory in Mombasa, removing the reserve price in September 2024 and reviewing the second payment model to allow quarterly payments.

He said the Tea Industry Regulations and the review of the second payment model are expected to be finalised between October 2025 and June 2026.

Miraa exports

On miraa exports, Kagwe confirmed that Kenya ships between 13 and 17 tonnes daily to Somalia, dismissing reports suggesting over 40 tonnes as “wildly exaggerated and not supported by any verified records.”

He attributed variations in reported volumes to market fluctuations, cargo capacity, and supply dynamics.

“For the first time, miraa export data is seamless, verifiable, and synchronised across all agencies,” he said, noting the harmonisation of records between the Agriculture and Food Authority (AFA), KenTrade and Kenya Revenue Authority.

Kenya produces an estimated 32,000 metric tonnes of miraa annually, valued at Sh13 billion, with 80–90 per cent consumed locally. Nearly 110,000 farmers cultivate the crop on roughly 360,940 acres, supporting over 1.4 million livelihoods.

To strengthen export oversight, the Ministry has introduced mandatory airway bills and flight manifests, compulsory KEPHIS inspections, deployment of AFA inspectors at warehouses, and monthly airline reporting to Kenya Airports Authority.

The government is also exploring alternative export routes to stabilise supply and reduce logistical costs, including additional landing ports in Somalia, road export corridors in northern Kenya and direct miraa cargo flights from Isiolo to Manda Island.

Farmers are being supported through irrigation projects, market sheds, boreholes and Sh220 million in seed capital for cooperatives, while the Miraa Research Institute continues focusing on research, value addition and market development.

Since 2023, Sh67.9 million collected in miraa levies has been reinvested into research, market expansion, and infrastructure improvement.

“The government remains fully committed to professionalising the miraa value chain and unlocking new export markets for our farmers,” Kagwe said.

Top Stories Today